How I bought 1,100 properties for $11.00 each and sold them for $500 each ($550,000)

By Steven Butala

How I bought 1,100 properties for $11.00 each and sold them for $500 each ($550,000).

Just about every year most of the counties in Arizona hold what’s called a tax deed sale. The gist of it is as follows: Property owners fail to pay their taxes for whatever reason. Incidentally, the single number one reason property owners fail to pay their taxes is that they are dead. There are many triggers that cause people to discontinue to pay their property taxes, and they are usually the same triggers that cause them to sell their property to people like me for pennies on the dollar. Anyway, property owners fail to pay their taxes and after about five years, the state of Arizona has the right to take back the property in a foreclosure proceeding. The result of this is that each county is tasked with selling these properties at an auction. In all the years that I’ve been attending these auctions I’ve only ever seen a single family residence or a mobile home type property involved in these proceedings a couple of times.

The property involved in this type of auction is almost always rural lots and acreage.

Turns out, this is my kind of auction.

I have hundreds and hundreds of stories about attending these auctions all over the country. Check out our podcast and related free content. Some of my best stories about buying property at live auctions in there.

This story is in the top five.

Once in awhile, county officials get lazy or complacent. Or maybe they just run out of time. By law, the county must follow statutory procedures when they hold an auction. Even though it’s the 21st century, a list of the properties to be auctioned off must be published in a newspaper. Often, this is the only place counties publish this information. And in this case, it did not make the Internet. This is not the first time this has happened, so I have a $12.00 a year subscription to the particular small town paper where this information is published once a year. So I showed up at the auction and there were only 5 or 10 other people/bidders.

I know from experience, that most of the other people who attend these auctions are local people. And I don’t mess with the locals. They usually are interested in one or two properties that may be surrounding land that they already own. This auction had about 150 or 200 properties listed. This is usually the sweet spot for most auctions, because an auctioneer will run out of energy and time after about 180 properties or so. This is true of all types of auctions, regardless of what is actually being sold; Cars or furniture or whatever.

As the story unfolded, this county had about 1,500 properties to get rid of. Or, more specifically, to get back on the tax rolls. It’s important to remember that counties love to get property back on the tax roll, meaning the new buyer at the auction is now responsible for paying the taxes on a go forward basis.

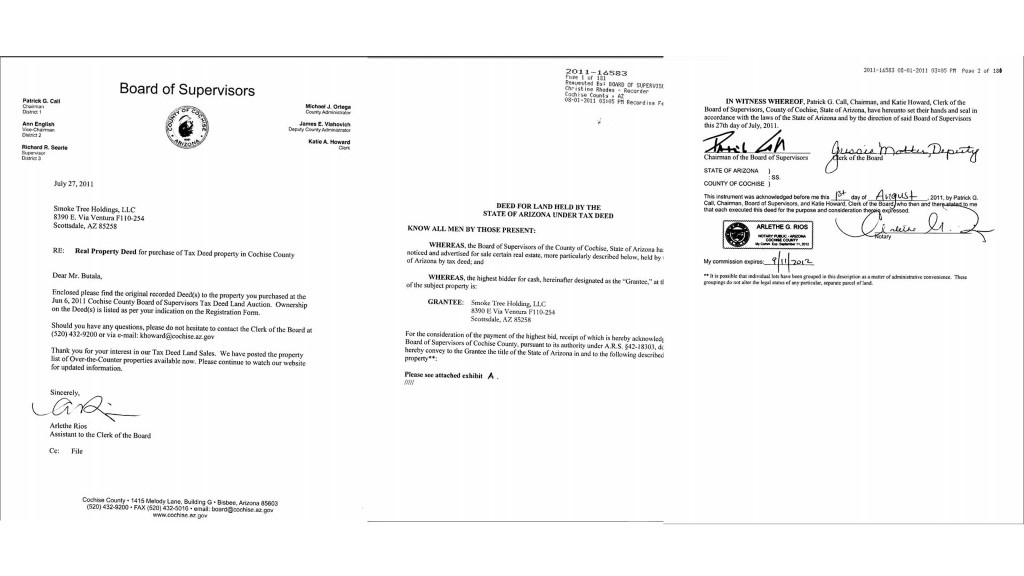

1,500 properties is way too many to be auctioned off individually and in one day. So the last line item in the auction contained about 1,100 properties. I bought all of them for $10,000. And I was uncontested (not bid against).

All of the locals already got the property they wanted. $10,000 divided by 1,100 properties is $11.00 per property. The deed was 181 pages long.

This auction took place in Southern Arizona on a Monday. It was about a 3 hour drive back to Scottsdale. It told myself as I sat in the car in the parking lot that by the time I got home I would have all these properties sold. I got on the phone, called my top five customers who I know love this property type. Incidentally, these properties, with few exceptions, were about ¼ acre each in a subdivision.

There were several properties in the package that were more than 50 acres. I actually didn’t even know about that until a couple weeks later.

I pulled in my driveway about four hours later, and a guy I bought a bunch of properties from several years prior was in the process of wiring me over 500,000 bucks.

The real beauty of this story is that the guy who bought the properties from me will make more than a million dollars on this deal. This was a few years ago, and I know he still selling them for $99.00 down and $99.00 a month. If they were all sold or placed at the same time, he would be making $55,000 a month!!

As you probably know by now, we offer a self-education course called “$10,000 a Month for Life; Cash Flow from Land.” Purchasing property at tax sales is covered in-depth in this course. While it is not the mainstay of how we buy property, it can be a great supplement to the bread-and-butter way we purchase property, which is what I call the “direct mail” method. Making low priced offers via direct mail has made us rich.

If you are interested in learning more about how to buy super inexpensive property and selling it for a lot more, drop us a line at support@LandAcademy.com. And make sure you download our free eBook. It covers these topics in pretty good detail, and lets you know what you can expect from the self-study course.