Buying Selling Land in a Recession – Here’s what we do to survive.

By S Jack Butala

My organization has purchased and sold about 16,000 properties since the early 1990’s which makes us the unwilful survivors of two economic recessions and one depression. We are heading into the next one coming off the most prosperous economic environment our country has experienced in about 5 decades.

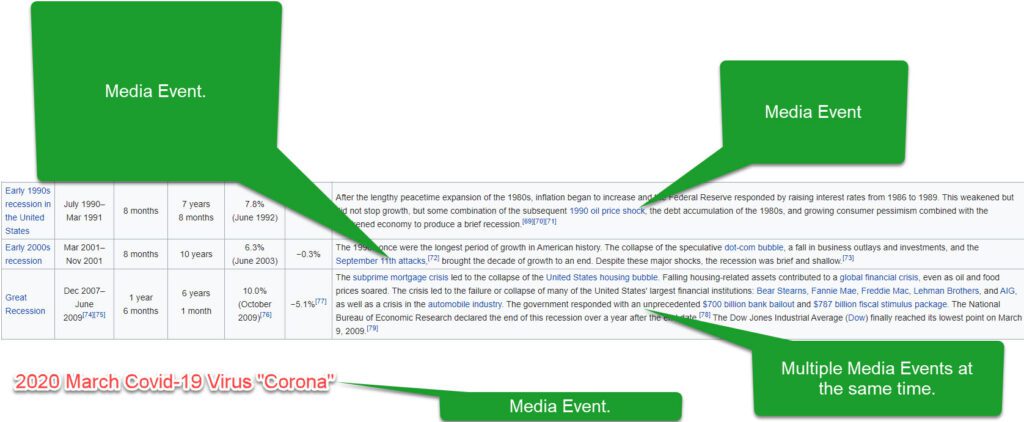

All recessions have a few things in common; they all start with a news media event which triggers consumer emotion, that emotion manifests itself in less spending (until another media campaign positively changes consumer perception), less emotional or confident consumers resume pent up spending, and finally the economic indicators tell us all that we are no longer in a recession.

If I sound cynical, it’s because I am.

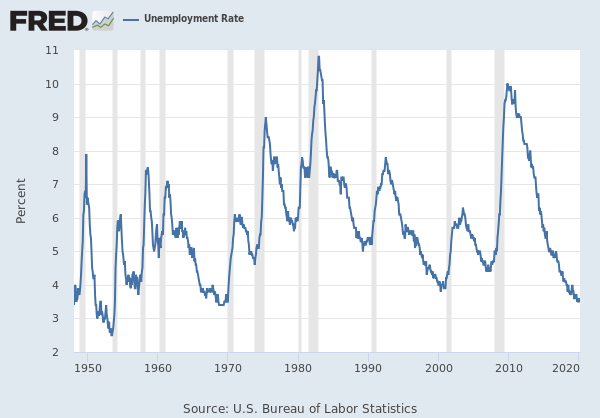

These recessionary media events don’t affect the VAST majority of us (about 95%). If they do, its usually in the form of job loss or as a small business owner, loss of revenue. For example, in good times the national unemployment rate is about 5% and is the worst of times is about 10%. This means about 16.5M people become unemployed (330,000,000 * 5%) but $314.5M remain employed or 95% of the county.

Nobody wants job loss and less consumer spending. The fact is, all free market based economies are cyclical. My point here is (and with compassion) the real-life tragedy of a recession affects a small percentage of people and a large percent of people change their spending decisions based on emotion.

We are land investors. We buy property from willing sellers at prices below current value and sell the land at market prices or slightly below to willing buyers. We do this in all economic climates.

Here are questions I get every time we discuss this topic;

⦁ Will the purchase price of land be affected by a recession? Yes, it will go down.

⦁ Will the sale price of land be affected by a recession? Yes, it will go down.

⦁ Will more land be available to buy (will more offer recipients sell their property)? Yes.

⦁ I have sold a lot of property on terms. Will my buyers who are making payments default more? Yes. 50% more will default on their payments.

⦁ Is it harder to sell land online like I usually do? No. Because you are buying it cheaper and now selling it cheaper. Your buyer base is bigger. People want cheap(er) property.

⦁ Should I lower my prices on my next acquisition mailer? Yes. By as much as 25% lower than normal.

⦁ Should I change how and who I sell property to? No. But change your titles to reflect the even lower sales price relative to all the other property out there.

⦁ Should I add my land product types to my portfolio. I usually buy rural land. Should I but infill lots? Yes. Always add product types as an investor.

⦁ What should I change during a recession? Buy more land and use funding partners. People with money come out of the woodwork during a recession for bargains in real estate and commodities. If you have deals, they will buy. You need to put in extra effort to find them.

Remember this; US recessions are based on media events which cause emotion. No one I’ve known has ever said “I’m so proud of the decision I made yesterday when I was really really emotional.” I was thinking clearly and the next time I’m experiencing a ton of emotion, I’m going to make even bigger decisions and better ones about life events.”

My final advise is you should not have any emotion when buying and selling real property in any economic climate. When prices are lower, buy more and ramp up your selling efforts to account for any perceived changes in the market. Present your property like “this is a once-in-a-life-time opportunity to buy for this price.” And make sure you purchase it so inexpensively that you are truly offering a great opportunity for your buyer.