Real Estate Data: How to Make Data Driven Property Acquisitions 2021-2025

By S. Jack Butala

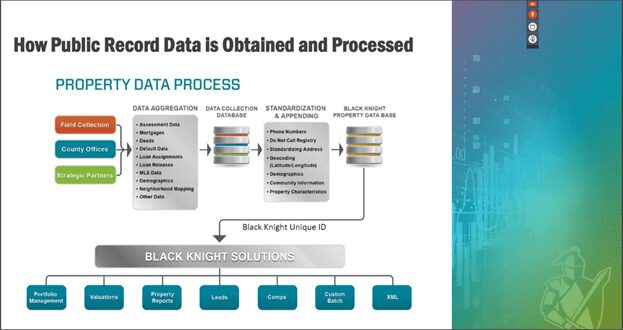

The real estate dataset for the US is finite at about $150M properties. Three data providers are in a race to capture the most robust dataset for each property in this dataset; CoreLogic, First American, and Black Knight. Each have specializations and methods of delivery that are industry-specific they are Oil and Gas, Title Insurance, and Mortgage industries, respectively.

Black Knight has recently released a custom platform named Rapid Analytics Platform or RAP for short. In their words this is its definition: it’s a cloud-based enterprise data and analytics solution that transforms the way companies work leverage data and enable decision science strategies in their workflow.

Within a single platform, users can immediately source data, execute queries, create advanced analytics and train machine-learning models. This helps organizations gain valuable insights to drive business growth, effectively manage risk, and respond quickly to the dynamics of an evolving market.

There are hundreds and hundreds of columns of data associated with any given property in the county. These data sets can be categorized based on what makes since to an investor.

Here is what it can do for property investors like us; after reviewing the entire 150M unit dataset, I would like to see properties with no improvement value (land) in zip codes where the spread between average completed sale value and the “for sale” values is largest. This tells me where to send out blind offers. Then I would like to see, within those geographic parameters, what acreage range is the widest. This tells me which owners or to whom to send blind offers. After scrubbing down to this dataset, I would like to know what the actual spread prices are. This tells me for how much to send each offer (how to price the offers).

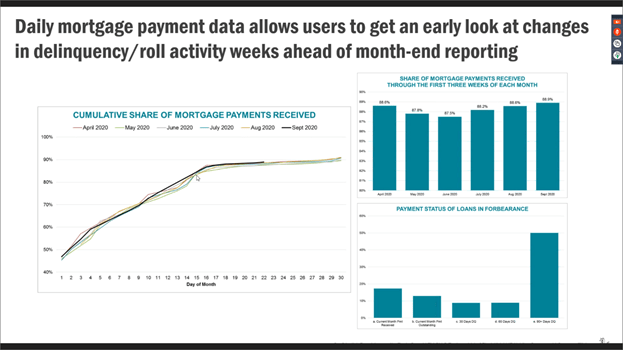

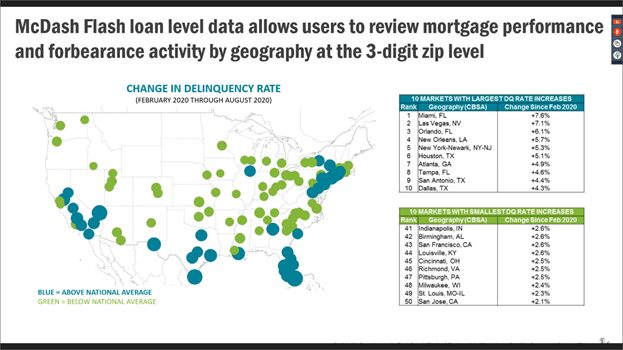

At present, we are building a custom cloud based application with Black Knight to automate this process for buying land and many other variations of this application and new data becomes available. RAP does an amazing job of putting this information into an automatically updated dashboard format which will tell us where to invest based on actual “constantly updated” activity in the market. Here are a couple simple examples of real-time data for a different client where forbearance and delinquency activity is their goal:

The next few years the relationship between real estate data and decision making will bring us into an age on par with the stock market. Nearly every aspect of the data to help automate decision making will exist or does now exist. It’s our job to see the data in a way that makes sense to us individually and to act on what that data tells us allowing us to create equity through acquisition and sale of real property.