One of the Greatest Real Estate Investment Opportunities of Our Life-Time is Here and Now in Affordable Housing.

By S. Jack Butala

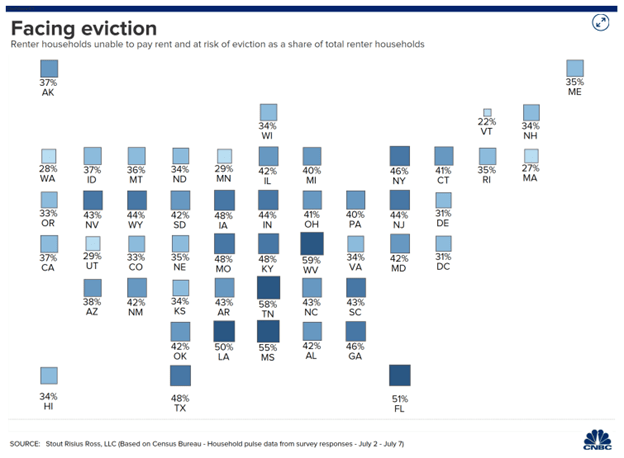

With the Pandemic of 2020, came temporary legislation allowing renters and mortgage holders to stop or delay paying landlords and debt holders with no real negative repercussions for their actions. This is unprecedented in U.S. history.

As of October 2020, approximately 34 million renters are at risk of evection and 2.9 million mortgage holders or 5.6 percent of homeowners are in some stage of forbearance.

https://www.cnbc.com/2020/10/02/millions-of-americans-may-not-be-able-to-pay-rent-in-october.html

https://www.cnbc.com/2020/10/09/coronavirus-mortgage-bailouts-fall-below-3-million-.html

Job loss has been sited as the primary reason for nonpayment. I believe there is something deeper here eating away at the reason people are not paying for primary housing; it’ simply gotten unaffordable.

Lender’s used to demand that a max of 25% of a household’s monthly net income should go toward housing. Studies like this from Harvard University and from Business Insider its clearly now about 40%. And one-size-fits-all does not apply here. The lower a household’s income, the higher of the net percentage of income goes toward housing.

The affordable housing crisis in America is officially here.

Since March of 2020, when the Pandemic became consisdent in the news, two industries began experiencing success like never before; mobile homes and recreational vehicles.

A summary of M/I here show their net income is up 90% and orders delivered are up 30% in 3Q of 2020. Winnebago reported 1.6 billion dollars of back logged orders here.

As historic investors of land, buying specific use property like mobile home or RV property is a logical extension of existing operations.

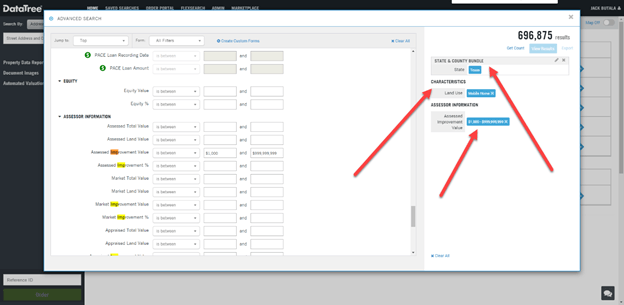

According to DataTree, there are about 700,000 property owners (land owners) in Texas that are currently hosting aging mobile homes.

These homes are existing and affordable and immediately available.

As successful land investors, it’s simple to send an offer to these land owners with mobile homes on the land seeking an undervalued acquisition; then assessing the property for clean up or replacement.

The net result for us is a profitable real estate deal and a new on-the-market affordable housing unit.